- عربي

-

- share

-

subscribe to our mailing listBy subscribing to our mailing list you will be kept in the know of all our projects, activities and resourcesThank you for subscribing to our mailing list.

Lebanon’s 2023 Draft Budget: Aimless expenditure

National budgets play a central role in public financial management by translating a country’s national goals into annual spending and revenue generating plans. Allocating resources in a coherent manner is a fundamental prerequisite for building an economy, whereby public expenditures are one of the main governance tools that states use to shape markets and deliver public services.2 Whether it is financing public works or social protection programs, public spending sits at the core of fiscal policy, which ultimately defines the social contract between the state, the political elites who control it, and citizens.

In Lebanon, the national budget has long been formulated with little to no concern for such principles. The ruling political class failed to enact budget proposals into laws for 12 consecutive years, and when they managed to pass a budget law, it was completed well after the constitutional deadline. In terms of content, Lebanon’s budget laws read like accounting documents and are void of macroeconomic targets and policy objectives. Lebanon’s 2023 draft budget—approved by the Council of Ministers and slated for submission to the parliament—is in keeping with this trend.

A review of the 2023 budget draft’s expenditure side exposes its alarming lack of size, direction, and connection to a medium-term recovery framework. Not only is the budget already eight months past its constitutional deadline and void of macroeconomic assumptions upon which figures are supposed to be calculated, but it has become little more than a payroll for the public sector. But even this payroll is flawed, as its real value is a fraction of pre-crisis levels and discriminates between types of civil servants. The following are six major concerns with the current 2023 budget draft.

Lebanon’s 2023 budget preparation misses the point

National budgets should be prepared ahead of a fiscal year, not during it. Moreover, they should be accompanied by complementary documents—such as the “Fazlake”—to provide the rationale behind revenue and expenditure projections. Lebanon’s budget preparation process for 2023 fails on both ends. The Ministry of Finance prepared the preliminary budget draft for 2023 with other ministries and sent it to the cabinet without a Fazlake on July 17, 2023, almost 11 months past the deadline.3 That way, the continued political disregard of fiscal affairs, coupled with capacity shortages in public administration, have already undermined the credibility of the 2023 budget, as only three months remain in the fiscal year.

The 2023 budget draft is small and shrinking faster than the economy

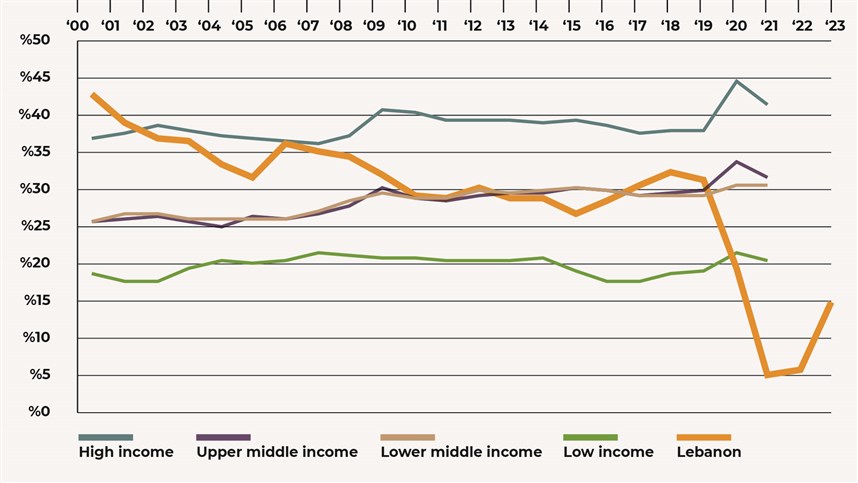

Lebanon’s projected public spending in 2023 totals LBP 199.3 trillion, or $2.36 billion using the average market exchange rate between January 2023 and June 2023. From 2000 to 2020, Lebanon’s budget spending as a share of GDP was in-line with countries of similar levels of economic development (Figure 1).4 In 2023, this ratio is expected to reach 15% of GDP, which is more than a twofold increase compared to 2022 (6%), but still well below pre-crisis levels (31%). This implies that public spending has shrunk at an even higher rate than that of the economy. In fact, while GDP contracted by 69% from 2019 to 2023,5 public spending decreased by 83% in real terms.

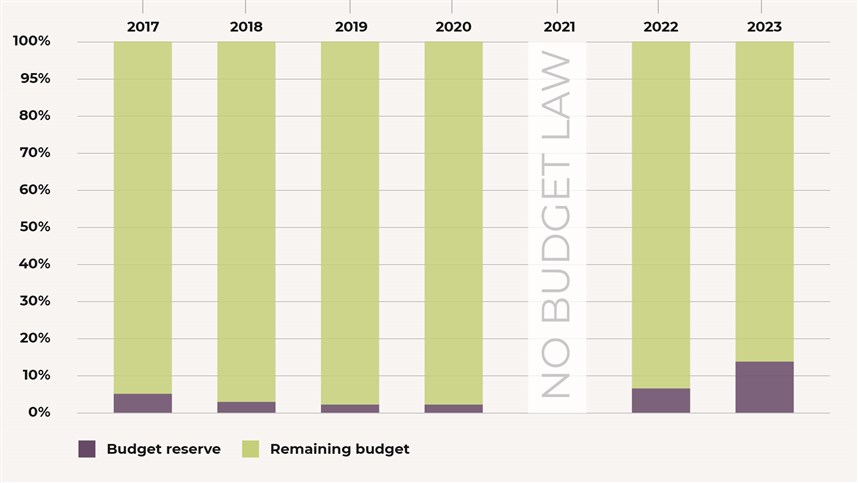

Figure 1: Budget expenditure as a share of GDP, 2017-2023

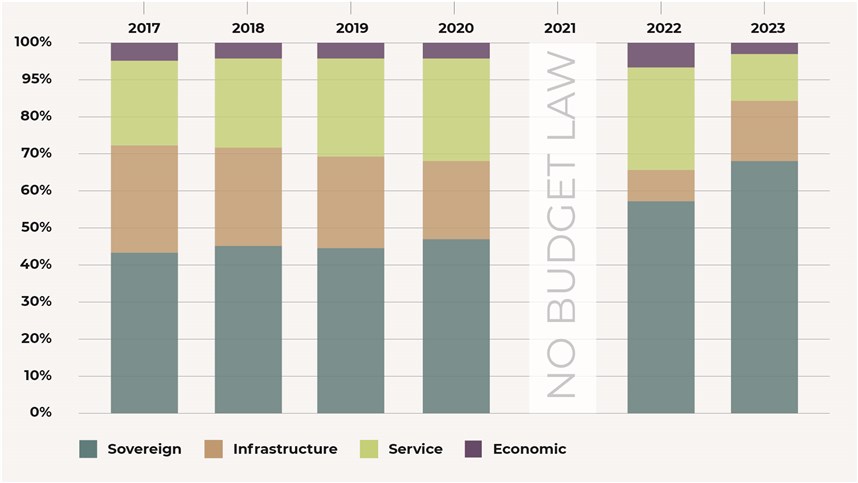

The 2023 budget draft slashes service ministries more than others

The state is rationing its fiscal resources in the 2023 draft budget in a manner that reflects the ministries it considers vital, with some sovereign ministries receiving a substantially larger portion of budgeted funds compared to service ones. Of the amount allocated to ministries, almost 70% is distributed across only five sovereign ministries (Finance, Interior and Municipalities, Defense, Foreign Affairs, and Justice), compared to 44% in 2019 (Figure 2).6 Unlike historical trends, the Ministry of Finance (MoF) received a substantial 39% of the budget assigned to line ministries and ranked first in terms of overall budget size, compared to 2019 when it was 6% and ranked seventh.7 This increase came at the expense of budgets for service (Education and Higher Education, Health, and Social Affairs) and infrastructure ministries. More specifically, the Ministry of Education and Higher Education (MEHE) was allocated 21% of the pre-crisis budget and dropped to 7% of the budget for ministries in 2023. The Ministries of Public Health (MoPH) and Social Affairs (MoSA) budgets, which previously received an average of 7% and 3% respectively, decreased to 6% and 1% in 2023. In real terms, the budget sizes for MoSA contracted by 94%, MEHE by 91%, and MoPH by 80%. Strikingly, the real value of all ministry budgets sharply contracted from 2019 to 2023, except for two: the Ministry of Finance (increased by 60%) and Ministry of Economy and Trade (increased by 10%).

While the 2023 budget draft appears to be expansionary compared to 2022, the real value of the budget has severely contracted. This reduction is most pronounced in public expenditures for service and infrastructure ministries, implying a continued weakening of public service delivery.8

Figure 2: Share of ministries budget, by type of ministry

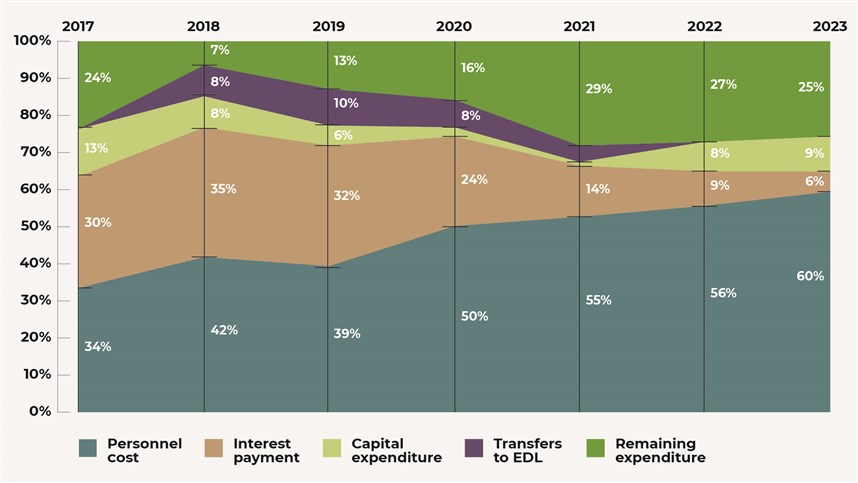

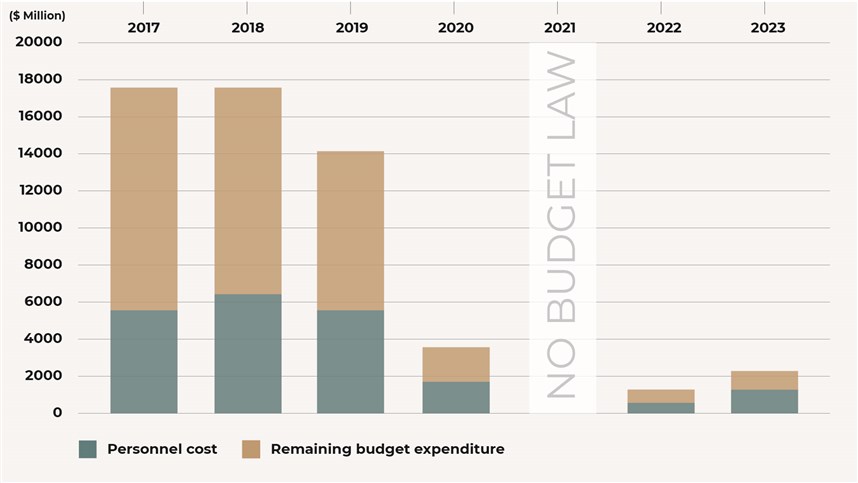

Most expenditures in the 2023 draft budget are allocated to personnel costs, yet it is not enough

Based on the 2023 budget draft, personnel costs total LBP 119 trillion (about 60% of total expenditures). Factoring in Laws 311 and 312, which opened exceptional credit lines worth LBP 37.7 trillion to finance personnel-related costs, the expenditures allocated for wages, salaries, and other social benefits to the public sector are projected to comprise 66% of total expenditures. This marks the largest share of personnel costs relative to the budget since the post-war era (Figure 3). However, personnel costs in 2023, including the credit lines, constitute one-third of their 2019 value in US dollar terms. (Figure 4).

Figure 3: Share of budget expenditure, by economic classification

Figure 4: Personnel cost relative to budget size (in $ million)

The recovery of wages and salaries is asymmetrical across types of civil servants

Overall, the budget line allocated for temporary public sector employees rebounded, increasing by 38% compared to 2019, while that of full-time employees represents less than 10% of their pre-crisis value (Table 1). Relative to the size of the total budget in each year, allocations for temporary worker salaries increased from 1% in 2019 to 14% in 2023.

Moreover, the Ministry of Foreign Affairs now has the largest discrepancy in wages across departments because some workers are paid in foreign currency (diplomatic corps) while others are paid in Lebanese pounds (central administration). In fact, the salary budget line for workers in the diplomatic corps is projected to be more than 400 times larger than that of civil servants in the ministry’s central administration.

The real value of personnel costs at core-service ministries like the MEHE, MoPH, and MoSA sharply decreased in the 2023 draft budget. Compared to 2019, MEHE’s decreased from $1 billion to $86 million, MoPH’s from $21 million to $1.75 million, and MoSA’s from $3.9 million to $0.4 million. Collectively, the budget lines allocated to personnel costs for these ministries decreased by an average of 97% compared to 2019, well above the 75% overall decrease in personnel cost across institutions.

Table 1: Salary line, by employment status of public sector worker (in USD million)

ِAd hoc spending is growing, and so is the budget reserve

According to Article 26 of the Public Accounting Law, the budget reserve should replenish exhausted budget lines that are common between ministries and finance emergency-related expenditure items. This form of public spending requires a decree signed by the prime minister and the minister of finance, which is inherently political in nature.

When spending is properly budgeted, the budget reserve should be minimal. Contrasting this best practice, the 2023 budget reserve is allocated the second-highest amount ($338 million) across institutions compared to the eighth-highest in 2019 ($350 million) (Figure 5). While reserve funds earmarked for emergency spending are an important resource because Lebanon’s macroeconomic landscape remains volatile, the significant increase in its budget share reflects some weakness in budget planning either from underreporting expenditure items or overestimating revenue projections, particularly as more than half the year has already passed.

Figure 5: Budget reserve as a share of total budget

Lebanon’s 2023 draft budget does more harm than good

Four years into the crisis, Lebanon’s political elites have not only refused to adopt substantive reforms but have also wasted the state’s dwindling resources. They approached the 2023 budget in an ad-hoc manner absent a medium-term fiscal framework and slashed social services funding without concern for its impact on citizens. Instead of expediting reforms and activating accountability and budgetary institutions, elites seem content to hollow out the state, and by extension, the economy and society.

1. This article is based on a forthcoming report and has been produced as part of The Policy Initiative’s collaboration with UNICEF under a joint project entitled “Analyzing and Advocating for Critical Policies and Reforms”, to promote independent research and policy advocacy. UNICEF does not endorse the viewpoints/analysis/opinions expressed by the authors.

2. Schuknecht, L. 2020. “Public Spending and the Role of the State: History, Performance, Risks, and Remedies.” Cambridge University Press.

3. Institut des Finances. Lebanon Citizen Budget – Budget Calendar.

4. International Monetary Fund. 2021. Data Mapper.; Note that data only includes spending from the budget.

5. Based on IMF’s estimate for GDP in 2023.

6. Calculation based on average exchange rate retrieved from lirarate.org which stood at USD/LBP 1,787 for 2019 and USD/LBP 84,495 between January and June 2023.

7. The high increase in the MoF’s budget is largely due to the social transfers to public sector employees and retirees.

8. World Bank. 2022. “Lebanon Public Finance Review: Ponzi Finance?” World Bank Group.

9. The economic classification divides the budget into the type of expenditure incurred based on their economic nature and purpose, such as salaries, goods and services, transfers, interest payments, or capital spending.

Related Output

view all-

06.08.22eng

تطويق الأراضي في أعقاب أزمات لبنان المتعددة

منى خشن -

10.12.22eng

فساد في موازنة لبنان

سامي عطاالله, سامي زغيب -

08.24.23

من أجل تحقيق موحد ومركزي في ملف التدقيق الجنائي

في بيان مشترك مع المفكرة القانونية، مبادرة سياسات الغد، كلنا إرادة، وALDIC، نسلط الضوء على التقرير التمهيدي الذي أصدره Alvarez & Marsal حول ممارسات مصرف لبنان وأهميته كخطوة حاسمة نحو تعزيز الشفافية. ويكشف هذا التقرير عن غياب الحوكمة الرشيدة، وقضايا محاسبية، وخسائر كبيرة. إن المطلوب اليوم هو الضغط من أجل إجراء تدقيق جاد وموحد ومركزي ونشر التقرير رسمياً وبشكل كامل.

اقرأ -

09.09.23

بيان بشأن المادة 26 من مشروع قانون الموازنة العامة :2023

المادة ٢٦ من مشروع موازنات عام ٢٠١٣ التي اقرها مجلس الوزراء تشكل إعفاء لأصحاب الثروات الموجودة في الخارج من الضريبة النتيجة عن الأرباح والايرادات المتأتية منها تجاه الدولة اللبنانية. بينما يستمرون في الإقامة بشكل رسمي في لبنان ويتجنبون تكليفهم بالضرائب بالخارج بسبب هذه الإقامة. كما تضمنت المادة نفسها عفواً عاماً لهؤلاء من التهرب الضريبي. وكان مجلس الوزراء قد عمد إلى تعديل المادة 26 من المشروع ال مذكور، فيما كانت وزارة المالية تشددت على العكس من ذلك تماماً في تذكير بالمترتبات والنتائج القانونية والمالية الخطرة لأي تقاعس أو إخلال في تنفيذ الموجبات الضريبية ومنها الملاحقات الجزائية والحجز عىل الممتلكات و الاموال. واللافت أن هذا الإعفاء الذي يشمل ضرائب طائلة يأتي في الفترة التي الدولة هي بأمس الحاجة فيها إلى تأمين موارد تمكنها من إعادة سير مرافقها العامة ومواجهة الأزمة المالية والإقتصادية.

اقرأ -

08.14.24eng

ما الذي أقرّته الدولة اللبنانية في أيار 2024؟

-

09.03.24eng

ما الذي أقرّته الدولة اللبنانية في حزيران 2024؟

-

09.11.24eng

ما الذي أقرّته الدولة اللبنانية في تموز 2024؟

-

02.05.25eng

أزمة لبنان بنيوية، لا وزارية

سامي زغيب, سامي عطاالله -

04.22.25eng

ما الذي أقرّته الدولة اللبنانية في آذار 2025؟

-

07.09.25eng

ما الذي أقرّته الدولة اللبنانية في حزيران 2025؟

اقرأ

From the same author

view all-

09.21.23

مشروع موازنة 2023: ضرائب تصيب الفقراء وتعفي الاثرياء

وسيم مكتبي, جورجيا داغر, سامي زغيب, سامي عطاالله -

02.05.25eng

أزمة لبنان بنيوية، لا وزارية

سامي زغيب, سامي عطاالله -

10.12.22eng

فساد في موازنة لبنان

سامي عطاالله, سامي زغيب -

10.15.24eng

لا عدالة مناخية في خضمّ الحروب

منى خشن, سامي عطاالله -

06.14.24

عطاالله: التدّخل السياسي عقبة أمام تطوّر الإدارة العامة

سامي عطااللهمقابلة مع مدير مبادرة سياسات الغد الدكتور سامي عطاالله أكد أن "التدخل السياسي هو العقبة الرئيسية أمام تطور الإدارة العامة"، وشدد على أن دور الدولة ووجودها ضروريان جدًا لأن لا وجود للاقتصاد الحر أو اقتصاد السوق من دونها"

اقرأ

More periodicals

view all-

01.15.26

ازدواجيّةُ المعايير لدى مُصنِّعي الإسمنت في لبنان: بين استخراج الموارد وحماية المشهد الطبيعيّ

منى خشنمن «الأحزمة الخضراء» إلى «المحميّات الطبيعيّة»، تعمل عمالقة صناعة الإسمنت في لبنان على تلميع صورتها البيئيّة فيما تواصل تشويه المشهد الطبيعيّ وإضرار الصحّة العامّة. إنّ إزدواجية المعايير البيئيّة لدى «الشركة الوطنيّة للإسمنت»، و«هولسيم»، و«سبلين» قد تتحوّل إلى بديل عن العدالة والمساءلة. اقرأوا مقالنا الجديد من كتابة الزميلة الأولى في مبادرة سياسات الغد د. منى خشن.

اقرأ -

12.19.25

المقالع تقضم الجبال: صناعة نظام اللاقانون

نزار صاغية, رين إبراهيمتضخّـم قطاع المقالع بعد عام 1990 بشكلٍ عشوائيّ، وتحوّل في معظمه إلى احتكارات تابعة لقوى نافذة تعمل خارج القانون. توثّـق هذه الورقة كيف تَشكّـل نظام اللاقانون في هذا القطاع، وما خلّفه من أضرار بيئيّة وماليّة واجتماعيّة، والدور الذي لعبته المواجهة القانونيّة–القضائيّة في إحداث أثر فعليّ على الأرض. ورقة بحثيّة من كتابة نزار صاغية ورين إبراهيم، ضمن مشروع “المناخ والأرض والحقّ” بالتعاون مع مبادرة سياسات الغد.

اقرأ -

11.21.25

وصفة لتبييض المسؤوليات في مجال الصرف الصحّي: الخلل في الصرف الصحي نظاميّ أيضًا

نزار صاغية, فادي إبراهيمتقدّم هذه الورقة خلاصةً دقيقة لتقرير ديوان المحاسبة الصادر في 27 شباط 2025 بشأن إدارة منظومة الصرف الصحّيّ في لبنان، مبيّنةً ما يعتريه من عموميّة وقصور، وما يكشفه ذلك من خللٍ بنيويّ في منظومة الرقابة والمحاسبة ومن الأسباب العميقة لتعثر محطّات معالجة الصرف الصحّي.

اقرأ -

04.24.25

اقتراح قانون إنشاء مناطق اقتصادية تكنولوجية: تكنولوجيا للبيع في جزر نيوليبرالية

المفكرة القانونية, مبادرة سياسات الغدتهدف هذه المسوّدة إلى تحقيق النمو الاقتصادي وخلق فرص عمل، غير أنّ تصميمها يصبّ في مصلحة قلّة من المستثمرين العاملين ضمن جيوب مغلقة، يستفيدون من إعفاءات ضريبية وكلفة أجور ومنافع أدنى للعاملين. وبالنتيجة، تُنشئ هذه الصيغة مساراً ريعيّاً فاسداً يُلحق ضرراً بإيرادات الدولة وبحقوق الموظفين وبالتخطيط الإقليمي (تجزئة المناطق). والأسوأ أنّ واضعي السياسات لا يُبدون أيّ اهتمام بتقييم أداء هذه الشركات أو مراقبته للتحقّق من تحقيق الغاية المرجوّة من المنطقة الاقتصاديّة.

اقرأ -

02.05.25eng

أزمة لبنان بنيوية، لا وزارية

سامي زغيب, سامي عطاالله -

10.15.24eng

لا عدالة مناخية في خضمّ الحروب

منى خشن, سامي عطاالله -

06.14.24

عطاالله: التدّخل السياسي عقبة أمام تطوّر الإدارة العامة

سامي عطااللهمقابلة مع مدير مبادرة سياسات الغد الدكتور سامي عطاالله أكد أن "التدخل السياسي هو العقبة الرئيسية أمام تطور الإدارة العامة"، وشدد على أن دور الدولة ووجودها ضروريان جدًا لأن لا وجود للاقتصاد الحر أو اقتصاد السوق من دونها"

اقرأ -

10.27.23eng

تضامناً مع العدالة وحق تقرير المصير للشعب الفلسطيني

-

09.21.23

مشروع موازنة 2023: ضرائب تصيب الفقراء وتعفي الاثرياء

وسيم مكتبي, جورجيا داغر, سامي زغيب, سامي عطاالله -

09.09.23

بيان بشأن المادة 26 من مشروع قانون الموازنة العامة :2023

المادة ٢٦ من مشروع موازنات عام ٢٠١٣ التي اقرها مجلس الوزراء تشكل إعفاء لأصحاب الثروات الموجودة في الخارج من الضريبة النتيجة عن الأرباح والايرادات المتأتية منها تجاه الدولة اللبنانية. بينما يستمرون في الإقامة بشكل رسمي في لبنان ويتجنبون تكليفهم بالضرائب بالخارج بسبب هذه الإقامة. كما تضمنت المادة نفسها عفواً عاماً لهؤلاء من التهرب الضريبي. وكان مجلس الوزراء قد عمد إلى تعديل المادة 26 من المشروع ال مذكور، فيما كانت وزارة المالية تشددت على العكس من ذلك تماماً في تذكير بالمترتبات والنتائج القانونية والمالية الخطرة لأي تقاعس أو إخلال في تنفيذ الموجبات الضريبية ومنها الملاحقات الجزائية والحجز عىل الممتلكات و الاموال. واللافت أن هذا الإعفاء الذي يشمل ضرائب طائلة يأتي في الفترة التي الدولة هي بأمس الحاجة فيها إلى تأمين موارد تمكنها من إعادة سير مرافقها العامة ومواجهة الأزمة المالية والإقتصادية.

اقرأ -

08.24.23

من أجل تحقيق موحد ومركزي في ملف التدقيق الجنائي

في بيان مشترك مع المفكرة القانونية، مبادرة سياسات الغد، كلنا إرادة، وALDIC، نسلط الضوء على التقرير التمهيدي الذي أصدره Alvarez & Marsal حول ممارسات مصرف لبنان وأهميته كخطوة حاسمة نحو تعزيز الشفافية. ويكشف هذا التقرير عن غياب الحوكمة الرشيدة، وقضايا محاسبية، وخسائر كبيرة. إن المطلوب اليوم هو الضغط من أجل إجراء تدقيق جاد وموحد ومركزي ونشر التقرير رسمياً وبشكل كامل.

اقرأ -

07.27.23

المشكلة وقعت في التعثّر غير المنظّم تعليق دفع سندات اليوروبوندز كان صائباً 100%

-

05.17.23

حشيشة" ماكينزي للنهوض باقتصاد لبنان

-

01.12.23

وينن؟ أين اختفت شعارات المصارف؟

-

10.12.22eng

فساد في موازنة لبنان

سامي عطاالله, سامي زغيب -

06.08.22eng

تطويق الأراضي في أعقاب أزمات لبنان المتعددة

منى خشن -

05.11.22eng

هل للانتخابات في لبنان أهمية؟

كريستيانا باريرا -

05.06.22eng

الانتخابات النيابية: المنافسة تحجب المصالح المشتركة