-

- share

-

subscribe to our mailing listBy subscribing to our mailing list you will be kept in the know of all our projects, activities and resourcesThank you for subscribing to our mailing list.

Tackling Lebanon's Crisis-Driven Tax Inequities

The Lebanese Parliament will vote on the 2024 budget today after the Finance and Budget Committee took the lead in reviewing and amending the cabinet’s draft. The current draft increases projected state revenue, but its tax regime is more regressive than in past budgets. Lower- and middle-income groups bear the greatest tax burden, sparing wealthier segments of society and interest groups from paying their fair share. Moreover, the 2024 budget fails to properly tax economic activities that mushroomed during the crisis and allowed a select few to amass wealth. In this article, we examine three economic activities that were largely left undertaxed: real estate transactions, imports, and debt settlements.

Real Estate Sector: A Missed Opportunity for Revenue

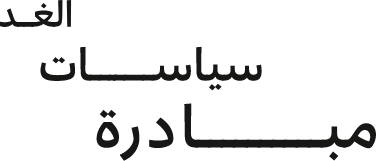

The real estate sector provides a stark illustration of how the devaluation of the Lebanese pound (LBP) affects tax revenues. Despite a surge in real estate transactions, which reached $15.6 billion in 2021, the Lebanese treasury faced staggering losses. Registration fees were collected at the outdated official exchange rate of 1,507.5 LBP/USD until February 2023, resulting in a substantial revenue loss of approximately $1.33 billion by December 2021. The fees per transaction plummeted from about $9,000 pre-crisis to just $720 in 2021, a drastic reduction in state earnings from one of the most active sectors in the economy.Figure 1: Revenue losses from real estate registration fees ($ million)

Luxury Imports: The Cost of an Artificial Rate

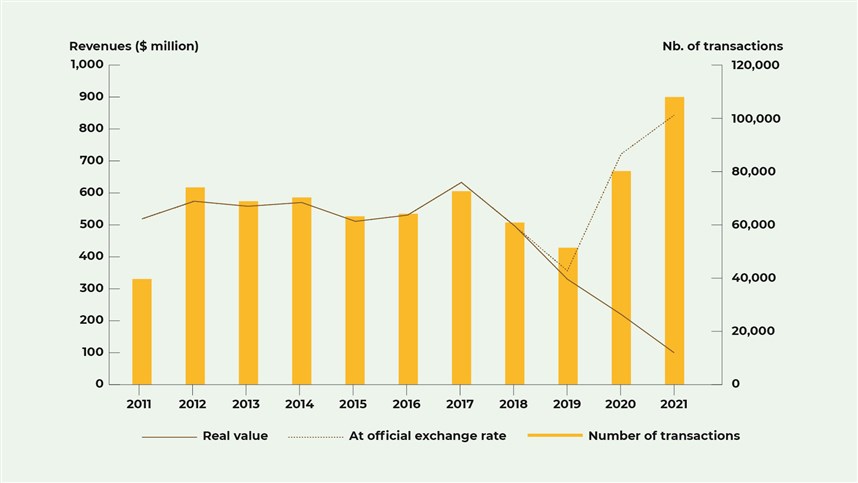

Using the official exchange rate for customs duties through December 2022 essentially subsidized imports. This practice led to revenue losses of about $2.8 billion, including $416 million in duties that could have been applied on luxury goods, such as high-end vehicles and jewelry. These losses highlight a regressive financial policy according to which the state, whether deliberately or not, subsidizes the consumption of the wealthy, eroding much-needed public funds.

Figure 2: Revenue losses from customs receipts ($ million)

Reforming the Tax System

A sustainable and equitable recovery would necessitate measures that not only address causes of future inequality, but also the structural inequalities that have been reinforced by the crisis and caused a major regressive re-allocation of wealth. The current budget does not address any of these urgent measures, and instead compensates for revenue losses through regressive manipulation of the exchange rate. To do so, the following reforms would be critical:

- Vacancy Tax on Property: Implementing a tax on unoccupied buildings to discourage real estate speculation and stabilize housing markets.

- Taxation of Loans and Real Estate Mortgages: Taxing the profits made by individuals who settled their loans at beneficial rates due to currency depreciation.

- Taxation of Undisclosed and Undeclared Revenues: Enforcing taxes on hidden profits and revenues from investments made during the crisis, especially luxury goods and real estate.

- Reform of VAT and Customs Tax: Adjusting VAT and customs tax rates to be more equitable, reducing the burden on end consumers, and correcting imbalances stemming from the use of multiple exchange rates.

These measures aim to establish a fairer tax system, addressing both historical issues and those exacerbated by the recent crisis. The success of these reforms hinges on their thoughtful design, transparent implementation, and the government's commitment to using revenue for social and economic recovery. Establishing a more equitable and efficient tax system will be a critical step in rebuilding Lebanon's economy and restoring public trust.

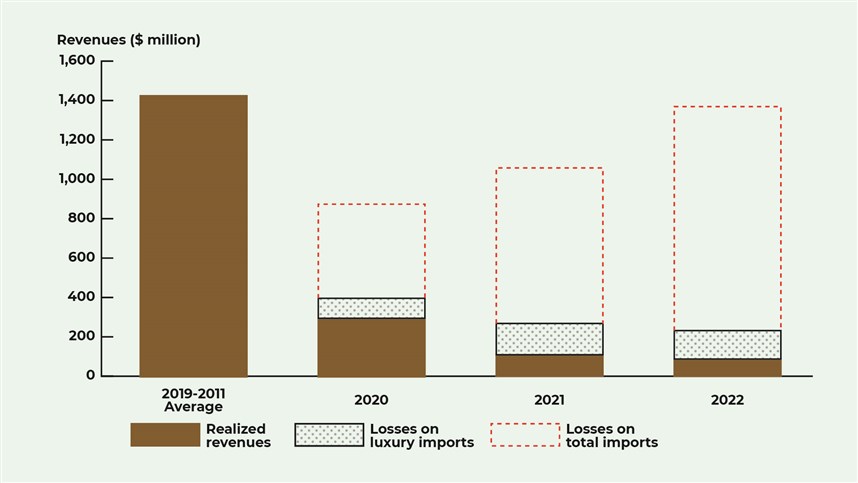

Figure 3: Credit payment, nominal and actual values, August 2019- July 2023, ($ billion)

Debt Settlements: A Windfall for Borrowers

LBP exchange rate disparities created an advantageous situation for borrowers, especially those with loans in foreign currencies. Under Circular 568, real estate loans up to $800,000 could be settled in LBP at the old official rate. This led to borrowers receiving a significant discount on their loans, effectively redistributing wealth from depositors to large borrowers and commercial entities.

The magnitude of these transactions is staggering. Theoretically, at the official exchange rate in place at the time, repayments would have amounted to about $45 billion in real terms. However, since the official exchange rate does not reflect the real value of the local currency on the parallel market, borrowers paid $11 billion. In other words, the discounted amount paid by borrowers since the crisis began totals approximately $34 billion – nearly double the size of Lebanon's current national economy. This is in practice a dramatic redistribution of wealth from depositors to large borrowers and commercial entities, creating market distortions that unfairly benefit credit-dependent companies over those with more robust capital reserves. These profits are considered additional income and should be taxed at a progressive rate; as according to the law, income that is not captured by other taxes is to be taxed at a progressive rate of 4% to 25%. However, due to obstacles related to the current banking secrecy laws, access to information that would allow the collection of these due taxes is not possible.

From the same author

view allMore periodicals

view all-

02.24.26

الحرب المستمرّة: إنذارات إسرائيلية لـ 13 قرية منذ بداية العام ومئات الوحدات المتضرّرة

إيناس شرّيمنذ مطلع العام، وجّهت إسرائيل إنذارات لمبانٍ في 13 قرية في جنوب لبنان والبقاع، أعقبتها غارات ألحقت أضرارًا بمئات الوحدات السكنية والتجارية، وتسبّببت بخسارة عشرات العائلات منازلها، في ظل استجابة رسمية محدودة. أعنف الاستهدافات كانت في 21 كانون الثاني 2026، حين وجّه العدو الإسرائيلي إنذارات إلى كلّ من قنّاريت والكفور وجرجوع والخرايب وأنصار. في أنصار مثلًا، طالت الأضرار 100 وحدة سكنيّة بشكل جزئي، ودمّر منزلان بشكل كامل فضلًا عن تضرّر 90 محلًا ومؤسسة تجاريّة بشكل جزئي أو متوسط. في الكفور، أدّت الغارات إلى تضرّر 110 وحدة سكنيّة بشكل جزئي و9 وحدات بشكل كبير باتت معه غير قابلة للسكن و4 وحدات دمّرت كليًّا.

اقرأ -

02.23.26

زيادة بِيَد وضريبة باليَد الأخرى: الهندسة الطبقيّة لتمويل الأجور وشَرْعَنَة الجباية من لقمة العيش

خالد سعدما يجري اليوم لا يبدو إنصافًا بقدر ما يبدو مقايضةً قاسية: تُمنَح الزيادة على الورق، ثمّ تُستعاد عمليًّا عبر ضرائب تطال كلّ ما يشتريه الناس. وهكذا يُوضَع الموظَّف العامّ في مواجهة الفئات الأخرى المتضرّرة من الزيادات الضريبيّة، على الرغم من أنّه يخضع للعبء نفسه.” اقرأوا مقالنا الجديد عن سياسة الحكومة الضريبية لزيادة أجور القطاع العام. من كتابة الباحث في مبادرة سياسات الغد، خالد سعد.

اقرأ -

02.18.26

تهديد مستشفى صلاح غندور: كيف تحاول إسرائيل نزع الحماية عن المرافق الصحّية في الجنوب؟

حسين شعبانيُظهر هذا التحقيق أنّ المسألة لم تعد تتعلّق بقدرة مستشفى على الصمود، بل بحدود المقبول قانونيًا وسياسيًا. فإذا سُمح بأن ينزع الغطاء المدني عن مرفق صحي بالاتهام وحده، يصبح أي مستشفى قابلًا للتجريد من حمايته بالكلام. وبهذا، تثبّت إسرائيل أنّ العمل الطبي في الجنوب اللبناني تحت التهديد بات قاعدة، لا استثناء. تم تحرير هذا المقال في إطار مشروع "مرصد إعادة الإعمار" الذي تنفّذه المفكّرة القانونية بالتعاون مع مبادرة سياسات الغد، استديو أشغال عامة، ومختبر المدن – بيروت.

اقرأ -

12.19.25

المقالع تقضم الجبال: صناعة نظام اللاقانون

نزار صاغية, رين إبراهيمتضخّـم قطاع المقالع بعد عام 1990 بشكلٍ عشوائيّ، وتحوّل في معظمه إلى احتكارات تابعة لقوى نافذة تعمل خارج القانون. توثّـق هذه الورقة كيف تَشكّـل نظام اللاقانون في هذا القطاع، وما خلّفه من أضرار بيئيّة وماليّة واجتماعيّة، والدور الذي لعبته المواجهة القانونيّة–القضائيّة في إحداث أثر فعليّ على الأرض. ورقة بحثيّة من كتابة نزار صاغية ورين إبراهيم، ضمن مشروع “المناخ والأرض والحقّ” بالتعاون مع مبادرة سياسات الغد.

اقرأ -

11.21.25

وصفة لتبييض المسؤوليات في مجال الصرف الصحّي: الخلل في الصرف الصحي نظاميّ أيضًا

نزار صاغية, فادي إبراهيمتقدّم هذه الورقة خلاصةً دقيقة لتقرير ديوان المحاسبة الصادر في 27 شباط 2025 بشأن إدارة منظومة الصرف الصحّيّ في لبنان، مبيّنةً ما يعتريه من عموميّة وقصور، وما يكشفه ذلك من خللٍ بنيويّ في منظومة الرقابة والمحاسبة ومن الأسباب العميقة لتعثر محطّات معالجة الصرف الصحّي.

اقرأ -

04.24.25

اقتراح قانون إنشاء مناطق اقتصادية تكنولوجية: تكنولوجيا للبيع في جزر نيوليبرالية

المفكرة القانونية, مبادرة سياسات الغدتهدف هذه المسوّدة إلى تحقيق النمو الاقتصادي وخلق فرص عمل، غير أنّ تصميمها يصبّ في مصلحة قلّة من المستثمرين العاملين ضمن جيوب مغلقة، يستفيدون من إعفاءات ضريبية وكلفة أجور ومنافع أدنى للعاملين. وبالنتيجة، تُنشئ هذه الصيغة مساراً ريعيّاً فاسداً يُلحق ضرراً بإيرادات الدولة وبحقوق الموظفين وبالتخطيط الإقليمي (تجزئة المناطق). والأسوأ أنّ واضعي السياسات لا يُبدون أيّ اهتمام بتقييم أداء هذه الشركات أو مراقبته للتحقّق من تحقيق الغاية المرجوّة من المنطقة الاقتصاديّة.

اقرأ -

02.05.25eng

أزمة لبنان بنيوية، لا وزارية

سامي زغيب, سامي عطاالله -

10.15.24eng

لا عدالة مناخية في خضمّ الحروب

منى خشن, سامي عطاالله -

06.14.24

عطاالله: التدّخل السياسي عقبة أمام تطوّر الإدارة العامة

سامي عطااللهمقابلة مع مدير مبادرة سياسات الغد الدكتور سامي عطاالله أكد أن "التدخل السياسي هو العقبة الرئيسية أمام تطور الإدارة العامة"، وشدد على أن دور الدولة ووجودها ضروريان جدًا لأن لا وجود للاقتصاد الحر أو اقتصاد السوق من دونها"

اقرأ -

10.27.23eng

تضامناً مع العدالة وحق تقرير المصير للشعب الفلسطيني

-

09.21.23

مشروع موازنة 2023: ضرائب تصيب الفقراء وتعفي الاثرياء

وسيم مكتبي, جورجيا داغر, سامي زغيب, سامي عطاالله -

09.09.23

بيان بشأن المادة 26 من مشروع قانون الموازنة العامة :2023

المادة ٢٦ من مشروع موازنات عام ٢٠١٣ التي اقرها مجلس الوزراء تشكل إعفاء لأصحاب الثروات الموجودة في الخارج من الضريبة النتيجة عن الأرباح والايرادات المتأتية منها تجاه الدولة اللبنانية. بينما يستمرون في الإقامة بشكل رسمي في لبنان ويتجنبون تكليفهم بالضرائب بالخارج بسبب هذه الإقامة. كما تضمنت المادة نفسها عفواً عاماً لهؤلاء من التهرب الضريبي. وكان مجلس الوزراء قد عمد إلى تعديل المادة 26 من المشروع ال مذكور، فيما كانت وزارة المالية تشددت على العكس من ذلك تماماً في تذكير بالمترتبات والنتائج القانونية والمالية الخطرة لأي تقاعس أو إخلال في تنفيذ الموجبات الضريبية ومنها الملاحقات الجزائية والحجز عىل الممتلكات و الاموال. واللافت أن هذا الإعفاء الذي يشمل ضرائب طائلة يأتي في الفترة التي الدولة هي بأمس الحاجة فيها إلى تأمين موارد تمكنها من إعادة سير مرافقها العامة ومواجهة الأزمة المالية والإقتصادية.

اقرأ -

08.24.23

من أجل تحقيق موحد ومركزي في ملف التدقيق الجنائي

في بيان مشترك مع المفكرة القانونية، مبادرة سياسات الغد، كلنا إرادة، وALDIC، نسلط الضوء على التقرير التمهيدي الذي أصدره Alvarez & Marsal حول ممارسات مصرف لبنان وأهميته كخطوة حاسمة نحو تعزيز الشفافية. ويكشف هذا التقرير عن غياب الحوكمة الرشيدة، وقضايا محاسبية، وخسائر كبيرة. إن المطلوب اليوم هو الضغط من أجل إجراء تدقيق جاد وموحد ومركزي ونشر التقرير رسمياً وبشكل كامل.

اقرأ -

07.27.23

المشكلة وقعت في التعثّر غير المنظّم تعليق دفع سندات اليوروبوندز كان صائباً 100%

-

05.17.23

حشيشة" ماكينزي للنهوض باقتصاد لبنان

-

01.12.23

وينن؟ أين اختفت شعارات المصارف؟

-

10.12.22eng

فساد في موازنة لبنان

سامي عطاالله, سامي زغيب -

06.08.22eng

تطويق الأراضي في أعقاب أزمات لبنان المتعددة

منى خشن -

05.11.22eng

هل للانتخابات في لبنان أهمية؟

كريستيانا باريرا -

05.06.22eng

الانتخابات النيابية: المنافسة تحجب المصالح المشتركة