- عربي

-

- share

-

subscribe to our mailing listBy subscribing to our mailing list you will be kept in the know of all our projects, activities and resourcesThank you for subscribing to our mailing list.

Lebanon’s 2023 Draft Budget: Taxing the many, sparing the rich

Lebanon’s taxation system is notoriously unfair, regressive, fragmented, and leaky to a point that it has deprived the State of fiscal resources and left the middle- and low-income class to foot the bill.

Every year, the Lebanese state can take structural corrective action by preparing and approving a national budget. The budget—which should delineate a government’s fiscal policy each year—is a fundamental tool for political authorities to determine how revenues are collected and expenditures are allocated in line with strategic objectives such as reducing income disparities and enhancing economic activity. Unfortunately, Lebanon’s political class consistently wastes this opportunity by opting for a fiscal framework that maintains the status-quo and caters to the few at the expense of the many.

An examination of the 2023 draft budget revenue structure and articles reveals its consistency with previous years’ drafts, as it disproportionately allocates tax burdens on those with limited income by imposing indirect taxes and minimizing taxes on those with capital and wealth. However, unlike pre-crisis years when Lebanon was able to generate revenue at a rate comparable with similar emerging economies, the country now lags, posing a serious threat to its overall fiscal capacity. The following are six key takeaways from the 2023 budgeted revenue.

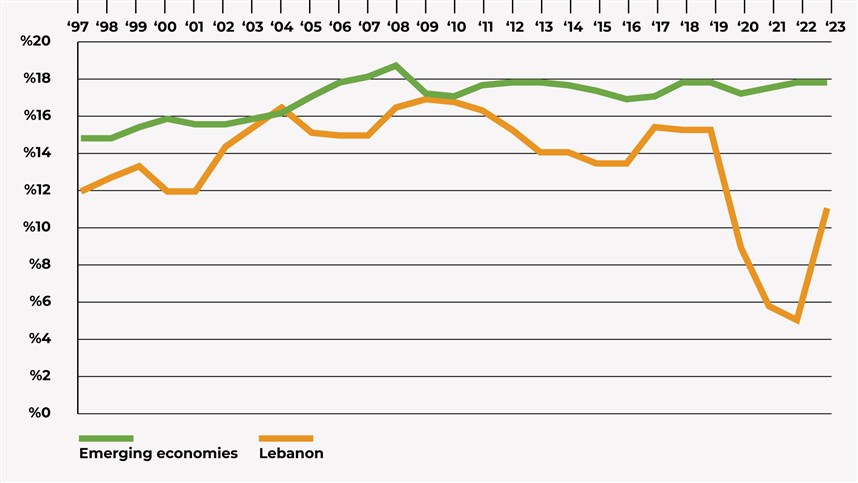

Lebanon’s tax-to-GDP ratio almost doubled since 2021 but its fiscal capacity is still alarmingly low

Overall, the 2023 draft budget projects that revenues will reach LBP 147,739 billion excluding treasury receipts—equivalent to $1.75 billion at the market rate1—and that the fiscal deficit will total approximately $610 million (4% of GDP). In real terms, revenues in 2023 are projected to be significantly below pre-crisis levels when compared to $8.89 billion in 2019. Moreover, the tax-to-GDP ratio of 11% in 2023 is below its 2019 share of 15%, despite doubling since 2022 (Figure 1). An 81% collapse in tax revenues is greater than the decline of GDP, which decreased by 69% over the same period, implying a deterioration of the state’s fiscal capacity. By extension, the gap in tax-to-GDP between Lebanon and emerging economies has widened during the crisis, increasing potential tax losses to $1.1 billion in 2023.2

Figure 1: Lebanon’s tax-to-GDP compared to emerging market economies

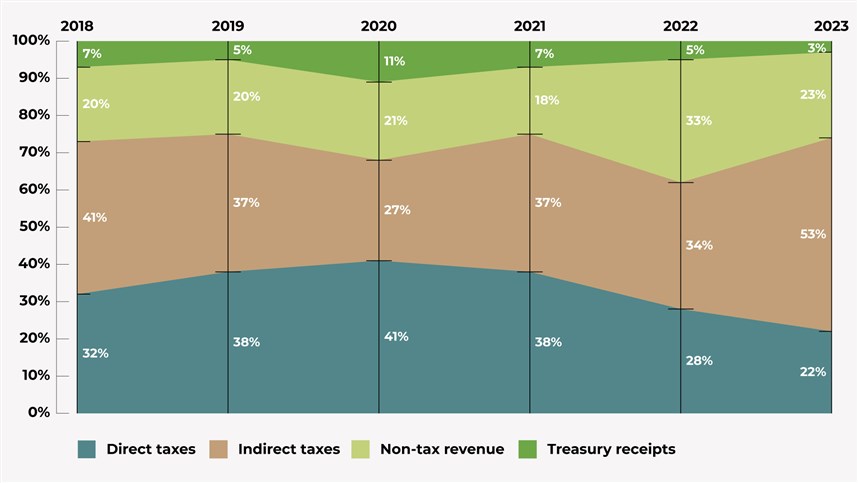

Lebanon is increasingly relying on indirect taxation

The share of tax revenue from indirect taxation is projected to increase from 37% in 2019 to 53% in 2023 (Figure 2), revealing the budget draft’s staggering reliance on regressive taxation as a primary source of resource generation. In fact, most expected tax revenues originate from domestic taxes on goods and services (52%), including VAT (24% of tax revenues), private car registration fees, and the passenger departure tax (12% combined, compared to 5% of tax revenues in 2022). These indirect taxes will have a detrimental impact on lower and middle-income individuals, who tend to spend a higher share of their income on consumption.

Figure 2: Composition of revenues from 2018 to 2023

The budget is light on progressive taxation, reducing its potential to spur revenue generation

Direct taxes are projected to constitute a mere 22% of projected revenues in 2023, down from 38% in 2019. Moreover, only 24% of projected tax revenues are collected at progressive rates—which apply to taxes on profits, wages and salaries, and property—while other sources of income, such as income from capital gains and interest, are taxed at a flat rate of 10% each. Similarly, the highest tax bracket on wages and salaries remains 25%, but the coverage was amended to include those who earn as little as $24,400 instead of $150,000 in the pre-crisis era.

Tax deductions benefit the banking sector

The draft budget plans to exempt financial institutions and the banking sector from the amelioration tax on re-evaluating their real estate assets to cover losses (Article 28). That way, the banking sector also benefits from artificial gains as, according to the Central Bank’s circular 659, banks’ assets are valued at the Sayrafa rate while their liabilities are calculated at the official exchange rate. This allows them to cover their large losses on their balance sheets.

Tax exemptions to the benefit of a lucky few

Article 26 plans to exempt taxes on foreign movable capital income acquired before 2022. Meanwhile, those generated during 2022 are expected to be declared and settled by individuals and entities within six months of the budget’s promulgation. Exempting foreign movable capital gains generated during earlier crisis years largely benefits more affluent and privileged households that possess foreign assets and constrains the state’s potential to generate further revenue.

The VAT threshold is still low and harmful to small and medium-sized businesses

VAT now applies to businesses with an annual turnover of LBP 2 billion or above (equivalent to $23,642 annually), up from the pre-crisis threshold of LBP100 million (approximately $1,180). While scaling up the threshold is overdue, four years on from the advent of Lebanon’s interlocking crisis, it is still significantly below the pre-crisis ceiling of $66,000, which was set based on the USD/LBP 1,507.5 exchange rate. This in turn falls short off protecting small businesses and fostering competition. It is also particularly problematic when considering that certain sectors and activities such as real estate—which is a highly profitable businesses—are VAT exempt.

The 2023 budget draft ambiguously taxes Sayrafa earnings

Article 80 plans to levy an exceptional 17% tax on individuals and entities that generated profits from Sayrafa since its expansion to an arbitrage platform.3 According to figures from Banque du Liban, the volume of transactions via Sayrafa from January 2022 to July 2023 reached a baffling $24 billion, with an estimated arbitrage opportunity of about $3.2 billion.4 While taxing such magnitude of undeclared profit is a significant source of revenue generation for the state, Article 80 imposes a flat rate across different profiles and population groups, such as between public sector and private sector employees, as well as between high-volume and low-volume traders, making it regressive. Moreover, the draft budget fails to outline the mechanism by which Article 80 will be enforced and information concerning traders will be collected.

The 2023 budget draft adopts a multiple exchange rate regime

Different taxes are levied at separate exchange rates, which will contribute to the expansion of the cash economy, accelerated inflation, and the creation of opportunistic or arbitrage opportunities. The exchange rates include the official rate (USD/LBP 15,000), the Sayrafa rate, and the parallel market rate, and will be applied to regulate transactions between importers, retailers, and consumers. As the spread between the Sayrafa rate and the market rate increases, importers and retailers can accumulate profits by benefitting from a discount on their taxes, at the expense of potential revenues to the state. Consumers, on the other hand, would suffer from rising prices.

Lebanon cannot avoid reforming its tax code for long

Lebanon’s ruling political class continue to impose heavier taxes on low- and middle-income households. The criminal response to the financial crisis has allowed inflation and the multiple exchange rate regime to annihilate people’s wealth while granting a selected few exploitative opportunities to make egregious profits. Now, the 2023 draft budget—the fourth during the crisis—continues to slash social services and heavily rely on regressive tax structures, severely impacting economically vulnerable population groups, which make up most of the country’s population. The implications for Lebanon’s social contract have already started taking shape, with people relying on informal subsistence channels and irregular labor arrangements. If Lebanon is to build a healthy economic recovery, anchored in an inclusive, rights-based social contract, a reform of its taxation system is of paramount importance. The political class can still make amendments to the 2023 draft via parliament’s Finance and Budget Committee and prepare a comprehensive draft for the 2024 fiscal year that is anchored in orderly public financial management and puts people first.

1. Tax revenues sum up to LBP 152,139 billion with treasury receipts; We estimate the real value by using the average yearly rate on the parallel market, sourced from lirarate.org. The parallel market rate averaged USD/LBP 16,212 in 2021, USD/LBP 31,170 in 2022, and USD/LBP 84,595 from January 1 to June 30, 2023. The official USD/LBP exchange rate in 2021 and 2022 was 1,507.5, which was changed in February 2023 to USD/LBP 15,000.

2. Authors’ calculation based on data retrieved from World Bank and International Monetary Fund.

3. Zoughaib, S. and W. Maktabi. November 2022. “BdL’s Sayrafa: Social Assistance of Last Resort?” The Policy Initiative.

4. Banque du Liban. Sayrafa Trading Volume; Authors’ calculation based on spread between Sayrafa and market exchange rates.From the same author

view all-

09.21.23

مشروع موازنة 2023: ضرائب تصيب الفقراء وتعفي الاثرياء

وسيم مكتبي, جورجيا داغر, سامي زغيب, سامي عطاالله -

02.05.25eng

أزمة لبنان بنيوية، لا وزارية

سامي زغيب, سامي عطاالله -

10.12.22eng

فساد في موازنة لبنان

سامي عطاالله, سامي زغيب -

10.15.24eng

لا عدالة مناخية في خضمّ الحروب

منى خشن, سامي عطاالله -

06.14.24

عطاالله: التدّخل السياسي عقبة أمام تطوّر الإدارة العامة

سامي عطااللهمقابلة مع مدير مبادرة سياسات الغد الدكتور سامي عطاالله أكد أن "التدخل السياسي هو العقبة الرئيسية أمام تطور الإدارة العامة"، وشدد على أن دور الدولة ووجودها ضروريان جدًا لأن لا وجود للاقتصاد الحر أو اقتصاد السوق من دونها"

اقرأ

More periodicals

view all-

01.15.26

ازدواجيّةُ المعايير لدى مُصنِّعي الإسمنت في لبنان: بين استخراج الموارد وحماية المشهد الطبيعيّ

منى خشنمن «الأحزمة الخضراء» إلى «المحميّات الطبيعيّة»، تعمل عمالقة صناعة الإسمنت في لبنان على تلميع صورتها البيئيّة فيما تواصل تشويه المشهد الطبيعيّ وإضرار الصحّة العامّة. إنّ إزدواجية المعايير البيئيّة لدى «الشركة الوطنيّة للإسمنت»، و«هولسيم»، و«سبلين» قد تتحوّل إلى بديل عن العدالة والمساءلة. اقرأوا مقالنا الجديد من كتابة الزميلة الأولى في مبادرة سياسات الغد د. منى خشن.

اقرأ -

12.19.25

المقالع تقضم الجبال: صناعة نظام اللاقانون

نزار صاغية, رين إبراهيمتضخّـم قطاع المقالع بعد عام 1990 بشكلٍ عشوائيّ، وتحوّل في معظمه إلى احتكارات تابعة لقوى نافذة تعمل خارج القانون. توثّـق هذه الورقة كيف تَشكّـل نظام اللاقانون في هذا القطاع، وما خلّفه من أضرار بيئيّة وماليّة واجتماعيّة، والدور الذي لعبته المواجهة القانونيّة–القضائيّة في إحداث أثر فعليّ على الأرض. ورقة بحثيّة من كتابة نزار صاغية ورين إبراهيم، ضمن مشروع “المناخ والأرض والحقّ” بالتعاون مع مبادرة سياسات الغد.

اقرأ -

11.21.25

وصفة لتبييض المسؤوليات في مجال الصرف الصحّي: الخلل في الصرف الصحي نظاميّ أيضًا

نزار صاغية, فادي إبراهيمتقدّم هذه الورقة خلاصةً دقيقة لتقرير ديوان المحاسبة الصادر في 27 شباط 2025 بشأن إدارة منظومة الصرف الصحّيّ في لبنان، مبيّنةً ما يعتريه من عموميّة وقصور، وما يكشفه ذلك من خللٍ بنيويّ في منظومة الرقابة والمحاسبة ومن الأسباب العميقة لتعثر محطّات معالجة الصرف الصحّي.

اقرأ -

04.24.25

اقتراح قانون إنشاء مناطق اقتصادية تكنولوجية: تكنولوجيا للبيع في جزر نيوليبرالية

المفكرة القانونية, مبادرة سياسات الغدتهدف هذه المسوّدة إلى تحقيق النمو الاقتصادي وخلق فرص عمل، غير أنّ تصميمها يصبّ في مصلحة قلّة من المستثمرين العاملين ضمن جيوب مغلقة، يستفيدون من إعفاءات ضريبية وكلفة أجور ومنافع أدنى للعاملين. وبالنتيجة، تُنشئ هذه الصيغة مساراً ريعيّاً فاسداً يُلحق ضرراً بإيرادات الدولة وبحقوق الموظفين وبالتخطيط الإقليمي (تجزئة المناطق). والأسوأ أنّ واضعي السياسات لا يُبدون أيّ اهتمام بتقييم أداء هذه الشركات أو مراقبته للتحقّق من تحقيق الغاية المرجوّة من المنطقة الاقتصاديّة.

اقرأ -

02.05.25eng

أزمة لبنان بنيوية، لا وزارية

سامي زغيب, سامي عطاالله -

10.15.24eng

لا عدالة مناخية في خضمّ الحروب

منى خشن, سامي عطاالله -

06.14.24

عطاالله: التدّخل السياسي عقبة أمام تطوّر الإدارة العامة

سامي عطااللهمقابلة مع مدير مبادرة سياسات الغد الدكتور سامي عطاالله أكد أن "التدخل السياسي هو العقبة الرئيسية أمام تطور الإدارة العامة"، وشدد على أن دور الدولة ووجودها ضروريان جدًا لأن لا وجود للاقتصاد الحر أو اقتصاد السوق من دونها"

اقرأ -

10.27.23eng

تضامناً مع العدالة وحق تقرير المصير للشعب الفلسطيني

-

09.21.23

مشروع موازنة 2023: ضرائب تصيب الفقراء وتعفي الاثرياء

وسيم مكتبي, جورجيا داغر, سامي زغيب, سامي عطاالله -

09.09.23

بيان بشأن المادة 26 من مشروع قانون الموازنة العامة :2023

المادة ٢٦ من مشروع موازنات عام ٢٠١٣ التي اقرها مجلس الوزراء تشكل إعفاء لأصحاب الثروات الموجودة في الخارج من الضريبة النتيجة عن الأرباح والايرادات المتأتية منها تجاه الدولة اللبنانية. بينما يستمرون في الإقامة بشكل رسمي في لبنان ويتجنبون تكليفهم بالضرائب بالخارج بسبب هذه الإقامة. كما تضمنت المادة نفسها عفواً عاماً لهؤلاء من التهرب الضريبي. وكان مجلس الوزراء قد عمد إلى تعديل المادة 26 من المشروع ال مذكور، فيما كانت وزارة المالية تشددت على العكس من ذلك تماماً في تذكير بالمترتبات والنتائج القانونية والمالية الخطرة لأي تقاعس أو إخلال في تنفيذ الموجبات الضريبية ومنها الملاحقات الجزائية والحجز عىل الممتلكات و الاموال. واللافت أن هذا الإعفاء الذي يشمل ضرائب طائلة يأتي في الفترة التي الدولة هي بأمس الحاجة فيها إلى تأمين موارد تمكنها من إعادة سير مرافقها العامة ومواجهة الأزمة المالية والإقتصادية.

اقرأ -

08.24.23

من أجل تحقيق موحد ومركزي في ملف التدقيق الجنائي

في بيان مشترك مع المفكرة القانونية، مبادرة سياسات الغد، كلنا إرادة، وALDIC، نسلط الضوء على التقرير التمهيدي الذي أصدره Alvarez & Marsal حول ممارسات مصرف لبنان وأهميته كخطوة حاسمة نحو تعزيز الشفافية. ويكشف هذا التقرير عن غياب الحوكمة الرشيدة، وقضايا محاسبية، وخسائر كبيرة. إن المطلوب اليوم هو الضغط من أجل إجراء تدقيق جاد وموحد ومركزي ونشر التقرير رسمياً وبشكل كامل.

اقرأ -

07.27.23

المشكلة وقعت في التعثّر غير المنظّم تعليق دفع سندات اليوروبوندز كان صائباً 100%

-

05.17.23

حشيشة" ماكينزي للنهوض باقتصاد لبنان

-

01.12.23

وينن؟ أين اختفت شعارات المصارف؟

-

10.12.22eng

فساد في موازنة لبنان

سامي عطاالله, سامي زغيب -

06.08.22eng

تطويق الأراضي في أعقاب أزمات لبنان المتعددة

منى خشن -

05.11.22eng

هل للانتخابات في لبنان أهمية؟

كريستيانا باريرا -

05.06.22eng

الانتخابات النيابية: المنافسة تحجب المصالح المشتركة